- What the F*** is Fashion-Tech

- Posts

- Chanel Just Dropped €80M on Turning Trash into Luxury

Chanel Just Dropped €80M on Turning Trash into Luxury

Remember when recycled fashion meant scratchy fleece made from plastic bottles? Well, Chanel just said "hold my poodle" and launched a whole ass company turning trash into luxury. If that’s not main character energy, I don’t know what is.

Chanel’s Circular Power Move

Last month, while we were all distracted by resort collections, Chanel quietly unveiled Nevold (wordplay on "never old")—a €50–80M venture that’s basically a high-end fibre recycling lab on steroids.

And no, this isn’t some greenwashing side hustle tucked into a sustainability report. Nevold is Chanel’s official "third pillar", alongside Fashion and Métiers d’Art (their heritage craft houses). Leading the charge? Sophie Brocart—an engineer-turned-Patou-CEO who clearly knows how to marry tech with luxury.

Even bolder? Nevold isn’t just for Chanel, it’s B2B. that means your fave emerging brand could one day buy Chanel-grade recycled fibres.

Now, What the F** are they Actually Doing?

Nevold brings together Chanel’s existing circular initiatives:

L’Atelier des Matières – dismantling old bags and accessories

Filatures du Parc – spinning recycled yarns

University partners – like Cambridge, for R&D

They’ve already developed recycled/virgin hybrid for their iconic tweeds, and a recycled leather composite used in 30% of their bag interiors. Not bad for fashion’s favourite perfectionist.

"Polyester is Evil" - Debunking Fashion Fairy Tales

To understand why Chanel’s making this move, we need to talk about the villain of every sustainable fashion doco: polyester.

Yes, it’s plastic. Yes, it sheds microplastics— indeed 35% of ocean microplastics come from our washing machines alone. And yes, it emits around 3.1 kg CO₂ per kg produced.

But every fibre has dirty secrets:

Cotton (The supposed hero): ~10,000L of water per kg, pesticide-heavy, up to 7 kg CO₂/kg.

Viscose (The shapeshifter): Made from trees, but processed with toxic chemicals and linked to deforestation. Emits ~10 kg CO₂/kg.

Wool (The surprise villain): Up to 80 kg CO₂/kg due to sheep methane burps.

So no fibre is innocent. Polyester is durable, cheap, and lower-emission than most naturals—but it releases microplastics during washing and at end-of-life. That’s the core problem. And since 69% of all clothes today are synthetic, recycling poly is now a must, not a maybe.

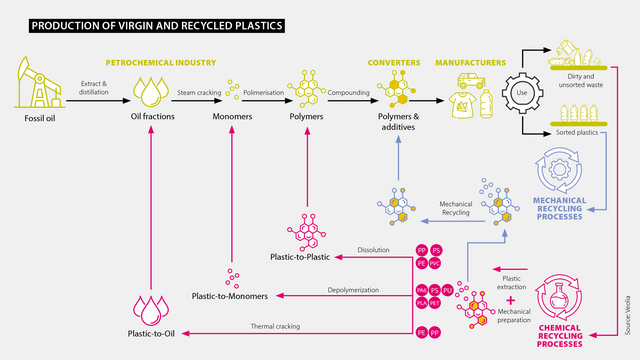

The Road to Recycled Fibres

Right now, less than 1% of textile waste becomes new textiles. The rest? Landfill, incineration, or dumped on the Global South. But innovation is heating up:

Mechanical Recycling (The OG)

Shred it, spin it, done. Works best on pure cotton but the fibres weaken. Think low quality, low shelf-life.

Chemical Recycling (The Glow-Up)

Cellulose (cotton/viscose): Renewcell turns cotton waste into pulp → viscose. H&M and Zara are already onto it.

Polyester: Tech like depolymerisation breaks it down into monomers. Eastman’s building a 150kt plant, Carbios uses enzymes to "digest" PET.

The Game-Changer: Circ

This US company, unlike others that deal with pure blends alone, has cracked the poly-cotton blend code—the fabric blend that makes up most of your wardrobe. They’re planning a $500M facility in France. Serious flex.

So Why Isn’t Everyone Doing This?

Because recycling textiles at scale is a f***ing nightmare.

1. Feedstock Drama

You need clean, sorted waste. What you get instead? Mystery fibres, stretch blends, and chaos. That’s why BlockTexx focuses on hotel sheets—they at least know what they’re working with.

2. Money, Honey

A recycling plant costs $300–500M. After Renewcell’s near-collapse, investors are scared. Players like Circ now require 5–10 year purchase agreements—a level of commitment the fashion industry isn’t used to.

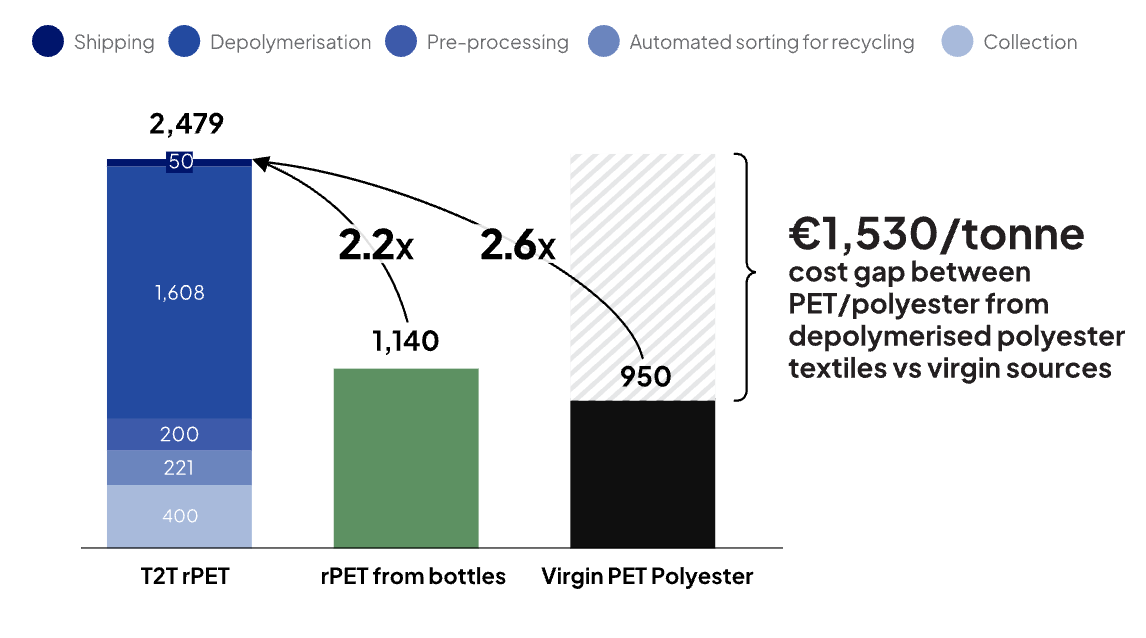

3. Price Squeeze

Recycled fibres cost 1.2–3x more than virgin ones. Until carbon taxes or enforced ESG disclosures change that, recycled will remain niche.

4. Consumer Hypocrisy

Brands want to be seen as sustainable. Consumers say they care. But tack $10 onto a recycled tee, and suddenly everyones silent. Except for a small few…

The Players: From Couture to Code

Luxury's Power Moves

Chanel (Nevold): €80M, open platform, already in production.

Kering: Opened Gucci’s Circular Hub in Italy.

LVMH: Investing in Stella McCartney’s mycelium leather and more.

Mass Market Muscle

H&M (Syre): $600M pledge, 3Mt capacity by 2032 (!).

Inditex: Invested in Circ, bought 2,000t of Circulose.

Uniqlo: Partnered with Toray for chemical recycling.

The Disruptors

Renewcell: Now under new ownership.

Infinited Fiber: 30kt plant coming in 2025.

Carbios: Enzyme magic, scaling with Indorama.

Samsara Eco (AUS): Enzymes in Lululemon jackets already.

What’s Next?

By 2030, we’ll likely see:

Recycled content minimums (20%) baked into regulation

Cost parity for recycled poly and cellulose (if carbon pricing kicks in)

Digital product passports on every garment - read last edition for more on this

Regional recycling hubs (no more shipping waste to Ghana)

Design for disassembly as standard practice

Future fibres like mycelium leather and carbon-capture yarns (Zara’s already in testing)

What does this mean for ANZ

We're sitting on 800,000 tonnes of textile waste annually. The opportunity? Massive. The infrastructure? Finally arriving.

Australia's new Seamless stewardship scheme mandates circularity by 2030. Suddenly, having local recyclers isn't nice to have, it's essential. Brands can't just ship problems overseas anymore. If you’re looking to pivot careers, now might just be the time…

Pop-Feature

BlockTexx

What they do: This Queensland startup solved fashion's biggest headache: poly-cotton blends. They separate the unseparable, turning old uniforms and hotel sheets into PolyTexx and cellulose powder and currently processing 4,000t/year.

Why it matters: They've cracked the business model: charge a "gate fee" (like landfill tipping) and sell the outputs. Clients include Workwear Group and Target Australia, and they're blockchain-tracking everything for transparency.

Impact scorecard: 9.5/10. They're processing commercial volumes of the hardest to recycle textiles, have real revenue streams, and are expanding. And most impressively they’re solving the hardest challenge of all - sustainability at scale.

As always, finishing up with a provocative question, can circular fibres scale fast enough to genuinely offset fashion’s waste, or are we just spinning our wheels? Drop us your thoughts.

See you in two weeks. Take care of yourselves and remember to check those care labels before your next closet clean out, someone's future wardrobe might depend on it.

Grace & Rak